Highlights of 2023

It was in many ways an eventful year and the Bank performed well. A new organizational chart was introduced at Arion Bank, and the companies in the Group continued to foster closer collaboration with the aim of providing customers with even better service.

Organizational changes

A new organizational chart was introduced in October when a new division was established, Operations and Culture. The changes are designed to bring key units closer together, enhance operational efficiency, manage transformation projects more effectively, and bring a clearer focus to service and customer experience. The division will also play a central role in developing and shaping the corporate culture of Arion Bank.

Birna Hlín Káradóttir, who has been General Counsel at Arion Bank since 2019, took over the role of Chief Operating Officer.

Arion Bank leading equities broker on Nasdaq Iceland for eighth year in a row

Arion Bank had the highest turnover in equities on Nasdaq Iceland in 2023, with a market share of 19.7%, the eighth year in a row it has achieved this distinction. The Bank also had the second highest turnover in bonds on Nasdaq Iceland in 2023, with 18.5%, and also had the highest market share on the Nasdaq First North market, with a 24.9% share.

The Bank was also played a leading role in the corporate advisory market, participating in four IPOs in Iceland during the year: Arnarlax, Hampiðjan, Kaldalón and Ísfélagið.

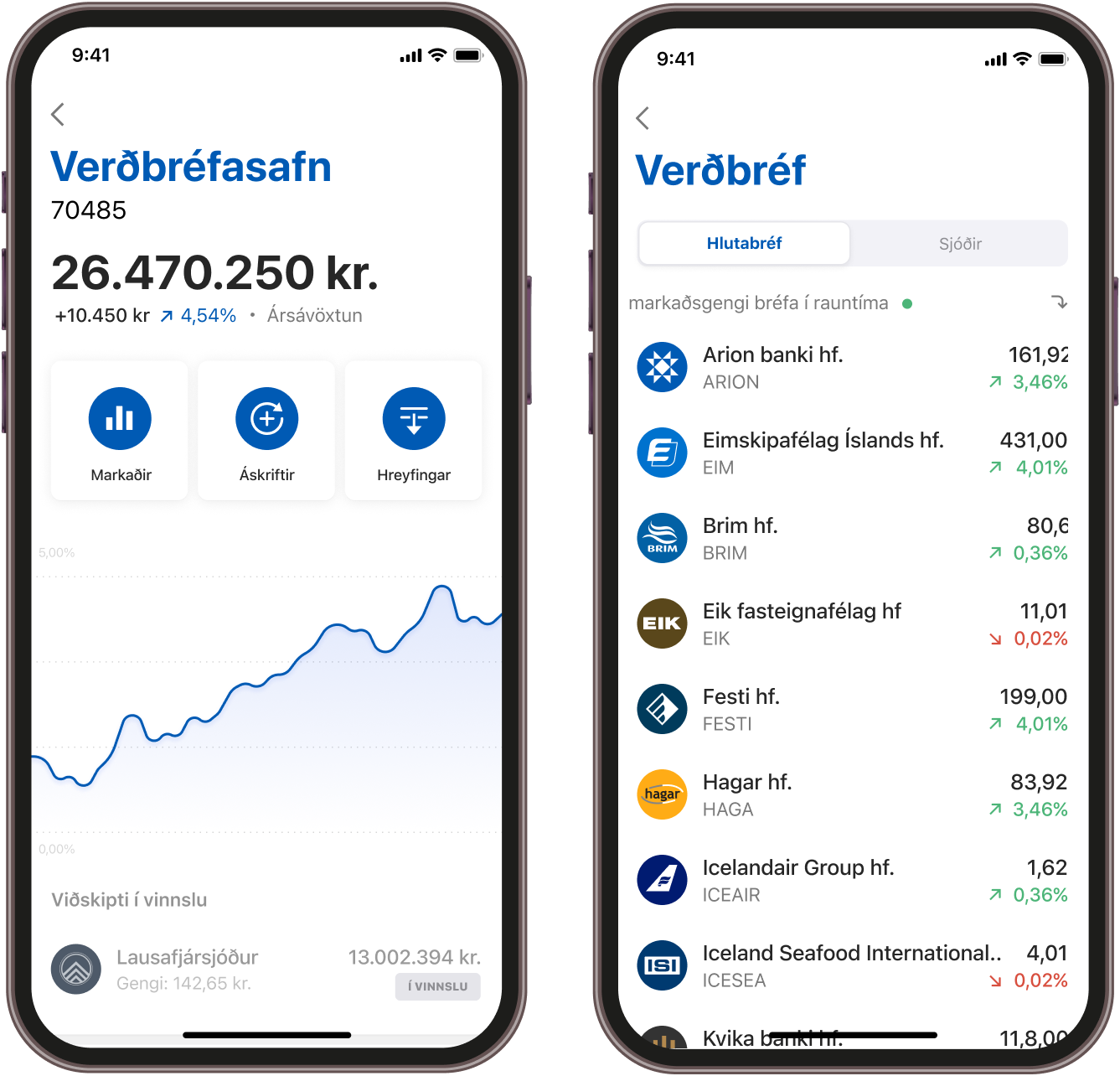

Best banking app seventh year in a row

The Arion app was voted the best banking app by bank customers for the seventh year in a row in a survey conducted by MMR. Various new features and updates were introduced during the year, including a new interface for payment cards and other new actions for debit and credit cards were enabled. Legal entities can also now trade with equities and funds in the app and online banking.

Vörður and Arion join forces in Selfoss

Arion Bank and its insurance subsidiary Vörður continued to develop their close partnership on banking and insurance. Vörður opened an office at Arion’s branch in Selfoss during the year. Customers can now obtain the full range of insurance and financial services in the same location and the partnership has got off to an excellent start.

Women invest

Women invest is long-term initiative organized by Arion Bank, the aim of which is to promote investment by women. The foundations for the project were laid in 2023 when Arion Bank decided to place a special focus on equal gender participation in the financial market.

The project was formally launched on 4 January 2024 at a well-attended opening event. This was followed by an advertising campaign, a new website, the first educational events were held and more are scheduled. The project has been very well received and it will be exciting to bring it to fruition and publish the first set of results in a year’s time.

From the opening event of the Women invest project.

Measures in response to volcanic activity in Grindavík

Following the period of intense seismic activity near Grindavík in November, Arion Bank offered to freeze the mortgages of its customers in Grindavík for three months and to waive interest and indexation on their loans for this period. In light of continuing volcanic activity Arion Bank has offered to freeze the mortgages of its customers in Grindavík for an additional three months and to waive interest and indexation on their loans until the end of April. The Bank will continue to closely monitor developments in Grindavík and do its utmost to support the community there.

Credit rating from Moody’s

The ratings agency Moody’s rated Arion Bank as an issuer of euro-denominated covered bonds. The rating is three notches higher than the Icelandic government’s rating. This highly positive rating will facilitate the Bank’s access to a broader group of bond investors.

Continuing sustainability journey

The CEO of Arion Bank, Benedikt Gíslason, signed a CEO statement with the CEOs of almost 80 Nordic signatories to the Global Compact expressing their support for the UN’s Global Compact's Ten Principles and Sustainable Development Goals, while upholding the targets of the Paris Agreement and urging further action to reach these targets. The statement was published in conjunction with COP28, the UN Climate Change Conference held in the United Arab Emirates.

In 2023 Arion Bank published sustainability policies applicable to the Bank’s lending to various sectors (seafood; industry, energy and manufacturing) and the Arctic. The policies align with the Bank’s focus and commitments with respect to sustainability.

At the end of 2023 Arion Bank committed itself to getting its climate targets validated by the Science Based Targets initative (SBTi). The targets aim to keep global warming below 1.5 C° and for Arion Bank to become net zero. Validation by SBTi confirms that the Bank’s targets are science-based and align with the commitments of the Paris Agreement.

The Bank has also joined the UN-convened Net-Zero Banking Alliance, a global group of banks committed to financing ambitious climate action.

Important milestones in development of Blikastaðir area

An important milestone was reached when the planning committee of the town of Mosfellsbær permitted the town’s planning officer to begin preparations for the first phase of the main plan for the plot of land at Blikastaðir. The first phase covers 30-35 hectares and is adjacent to existing built-up areas. The emphasis will be on accentuating the relationship between built-up areas and nature, varied means of transport, blue-green surface water solutions and more biodiversity in green areas. Approximately 1,200 to 1,500 residences will be built, divided into various types of single-family and multi-family dwellings, depending on the lay of the land and the proximity to major traffic routes.

The Blikastaðir plot covers around 98 hectares and is the largest plot of undeveloped land in the Greater Reykjavík area. The land is owned by Arion Bank through the company Blikastaðaland ehf. The area is expected to be home to around 3,700 residents, in a mixture of multi- and single-family dwellings, plus 150 apartments for people aged 55 and above, schools, sports facilities and commercial property covering 66,000 square metres. All areas of the design process will incorporate the UN Sustainable Development Goals and the built-up area will be BREEAM certified. Under the agreement with Mosfellsbær, Blikastaðaland ehf. takes part in the development of infrastructure in the area.

New strategy

The Board of Directors approved a new strategy, new values and service standards. The strategy reflects Arion’s focus on being the driver of our customers’ success, in Iceland and the Arctic, by offering diverse and smart financial solutions which enhance financial health and promote sustainable value creation.

More information on strategy and vision at Arion Bank can be found here.

Balance sheet

Arion Bank’s assets increased by 4,1% in 2023, growing to ISK 1,526 billion at year-end. Loans to customers increased by 6.3% from year-end, with a 8.2% increase in corporate lending and 4.6% growth in loans to individuals, mainly mortgages.

The Bank enjoys a solid liquidity position, due to funding on the wholesale markets, while customer deposits increased by 4.9%, from ISK 755 billion to ISK 793 billion.

In May 2023 Arion Bank issued €300 million senior preferred notes with a maturity of 3 years. The notes pay a coupon of 7.25% which corresponds to a spread of 407bp over mid-swaps. At the same time Arion Bank announced an invitation to holders of its outstanding €300 million senior notes due in May 2024. The Bank received valid tenders of EUR 220.4 million which were all accepted.

In November Arion Bank completed the sale of a new series of senior preferred bonds. The new series, ARION 28 1512, sold for a total of ISK 8.7 billion at a yield of 4.40%. The series is indexed-linked and will pay a coupon semi-annually. It matures on 15 December 2028.

Arion Bank continued to issue covered bonds in the domestic market. In 2023 the Bank issued covered bonds amounting to ISK 44.4 billion (of which ISK 22.6 billion were for own use).

The Bank’s equity amounted to ISK 199.3 billion at the end of 2023, increasing by ISK 11.3 billion during the year. This increase is mainly related to net earnings of ISK 25.7 billion in 2023, while the total was reduced by share buybacks and dividends, totalling ISK 15.6 billion. The Bank’s capital ratio was 24.1% at year-end, increasing from 24.0% at the end of 2022. However, the CET1 ratio increased from 18.8% to 19.7% in 2023.

Awards and recognition

The Banker magazine, a leading global finance news publication published by the Financial Times, named Arion Bank the Bank of the Year in Iceland for 2023, the third year in a row.

At the end of 2023 Arion Bank received an updated ESG risk rating from the international ratings agency Sustainalytics, which specializes in rating ESG risk. The rating was positive and Sustainalytics continues to rate the Bank as one of the best performing banks globally in this area.

Arion Bank also achieved the score “outstanding” in Reitun’s ESG rating in December 2023, placing it in category A3. The rating is based on the Bank’s performance in environmental, social and governance (ESG) issues in its operations. The Bank again scored 90 out of a possible 100 points, thus meeting the stricter requirements made in this year’s assessment. 90 points is the highest score given by Reitun, and the Bank is one of three issuers placed in category A3. Approximately 40 Icelandic issuers have been assessed.

On 22 August Arion Bank, Vörður and Stefnir were recognised for their excellent corporate governance and were therefore named as Model companies in corporate governance. The awards are presented by Stjórnvísi, the Icelandic Chamber of Commerce, SA Confederation of Icelandic Enterprise, Nasdaq Iceland.

Arion Bank became the first company in Iceland to get ISO 27001 certification for Information Security Management System.

FVH, the association of business and economics graduates, named Erna Björg Sverrisdóttir, Chief Economist at Arion Bank, as its Economist of the Year for 2023.